Investment Opportunities at the Intersection of Environment and Nutrition

Food systems are responsible for a third of global greenhouse gas emissions and yet almost 3 billion people cannot afford a healthy diet. While investors and donors are increasingly targeting “sustainable food” most financing still fails to consider both nutrition and environmental outcomes together.

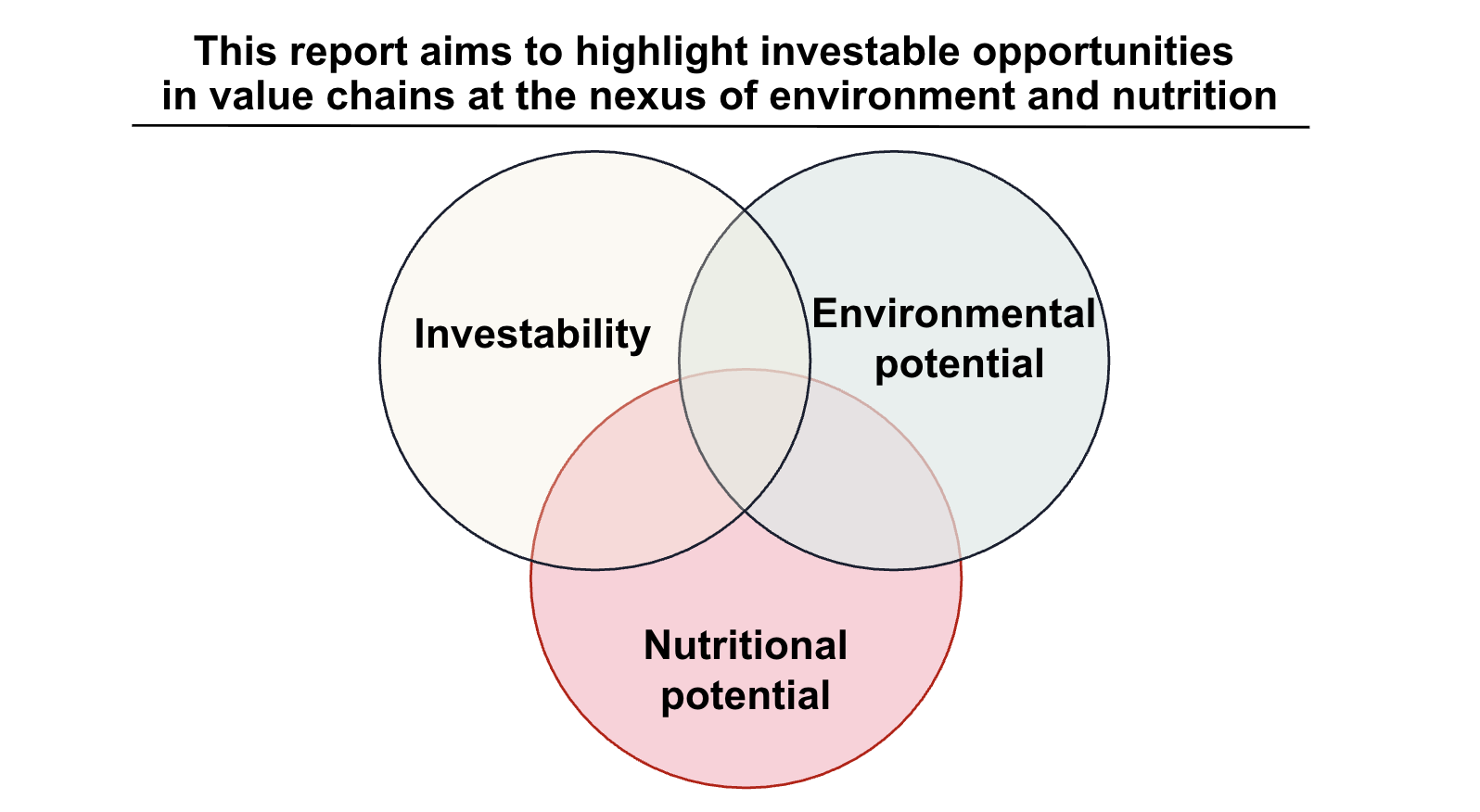

This report, sponsored by GAIN, explores where and how targeted investments in food value chains can simultaneously deliver strong nutritional impact and measurable environmental benefits, while meeting donor and investor ROI expectations. The report draws on the portfolios of seven Development Finance Institutions (DFIs), interviews with sectoral experts, and 12 case studies across six value chains - from vegetables and poultry in Africa, legumes and aquaculture in Asia, to fruits and milk in Latin America. Key findings show that:

Fruits, vegetables, and legumes combine high nutritional value with naturally low emissions, but also fast growth (10% CAGR in SSA's vegetable markets).

Animal-based value chains such as dairy, poultry, and aquaculture can lower their footprint through better feed, energy, and waste management, while unlocking new revenue streams from carbon and blue finance.

Across all value chains, wholesalers and aggregators can reduce waste (post-harvest losses are now up to 40% for vegetables in SSA, and 30% for fruits in Latin America) and boost farmer income, developing local distribution channels to ensure their own country benefits from their nutritious produce.